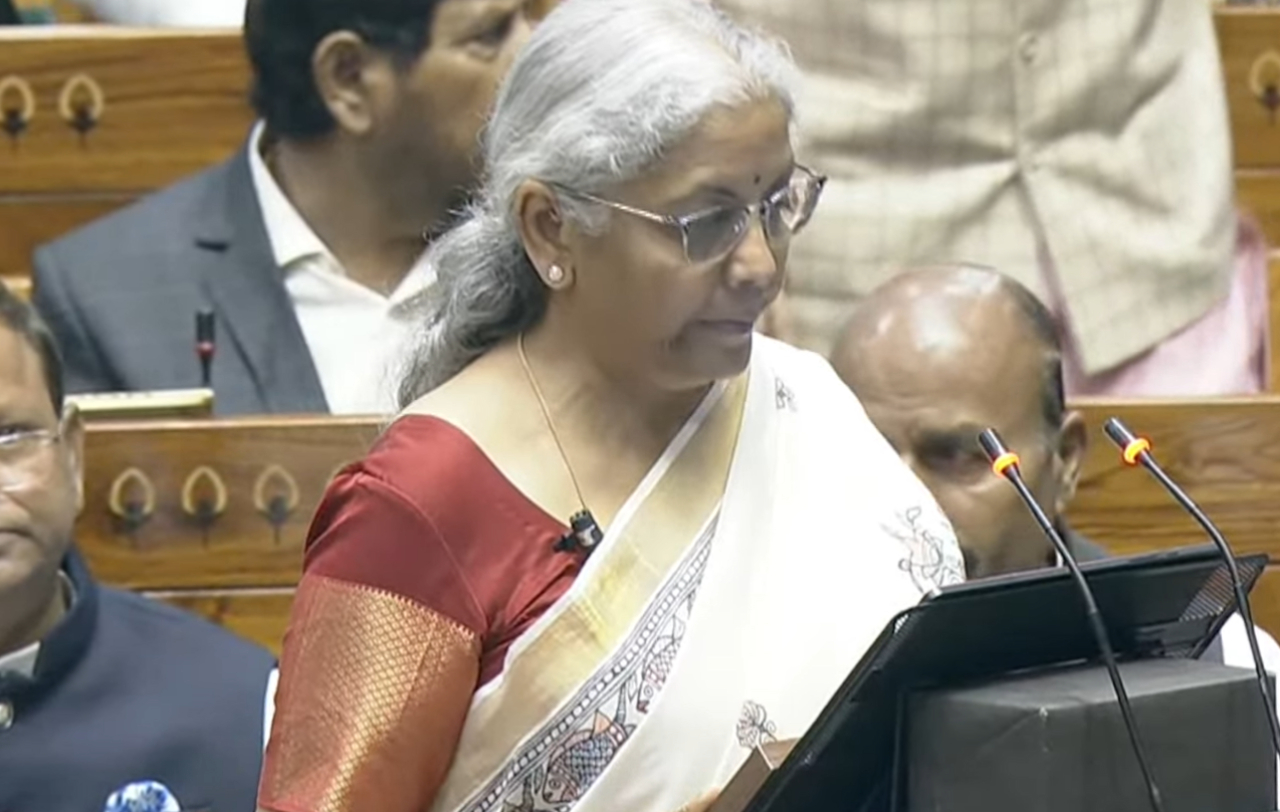

Union Budget 2025: Nirmala Sitharaman, all set to presented budget 2025. She started delivering it at 11:00 am on 1 Feb 2025. She wore a saree gifted by Dulari Devi and with the famous red tab. In this union budget, the proposed focus areas are on 10 KPIs with a major focus on Garib, youth, Annadata, and Nari. Spearing agricultural growth and productivity and building moral prosperity and resilience taking everybody on growth paths.

Boosting all the important sectors of growth and leading the way in upscaling MSMEs and employee-led development. A healthy relationship between economy and innovation along with securing energy supply promoting export and nurturing innovation. For this development, we need four powerful engines: Agriculture, MSME, Investments, and exports. This fuels our inclusivity to take us to our destination of Vikasit Bharat.

The union budget 2025 aims to transformative reforms across 6 domains-Taxation, power sector, urban development, mining financial sectors and regulatory reforms. Agriculture as the first engine.

Major Highlights and takeaways from Union BUDGET 2025:

Pradhan Mantri Dhan dhyana Krishi yojana was in highlight and taken to next level to 100 districts having low productivity and low intensity And below average credit parameters. The programme set to benefit 1.5 crore farmers. Highlights were in Atma nirbharta seeds, Atmanirharta in making edible oil. shri Anna scheme will be taken next level. Makhana board in Bihar will be established to improve production, processing, value addition and marketing of makhana.

Indian post will be transformed as large public logistics organizations.

Medical seats are increased to 75K. The most important 36 life saving drugs and medicines fully exempted from basic custom duty. Medicines and patient assistances free programs are exempted from customs duty.

No income tax payable up to 12 lakh. Slabs and rates marked the change across the board. New structure to reduce taxes of middle class so that middle class gets more money in hand.

Bihar gets three schemes. Limitations for tax deduction on interest for senior citizen doubled from Rs 50000 to 1 lakh. Annual limit for TCS on rent to be increased to 6 lakh. Threshold to collect tax raised from 7 lakh to 10 lakh.

Government to increase TCS on remittances under RBI’s liberalised remittance scheme from 7 lakh to 10 lakh. In the budget of July 2024, delay of payments of TDS up to due date of filling statements was decriminalised. New income tax bill will be proposed in next session a week later.

Fiscal deficit for FY25 at 4.8 percent of GDP with target at 4.4 percent of GDP at FY26. Sitharaman revealed that government will establish committee to check regulatory reforms. National bank financing infrastructure and development will introduce a partial credit for corporate bonds.

Highlights involved a framework to enhance and unlock the potential marine sector with sustainable harnessing of fisheries and major focus is on lakshwadeep and Andaman. UDAN scheme to be launched to improve regional connectivity to 120 new destinations. Greenfields airport facility will be provided in Bihar to meet future demands. financial support will be provided for western kosi ERM project in Mithalanchal.

Other highlights in Union Budget 2025

Extension of Mudra loans to build Homestay to promote Local Tourism sites. This will increase tourism at 50 spots.

Center of excellence in AI for education with investment of Rs 500 crore.

Insurance sector to be raised from 74 to 100 percentage.

The focussed scheme for footwear in leather sector will be aimed at boosting domestic production and global competitiveness. Government will take steps to dominate Manufacturing hub.

Bhartiya bhasha Pustak to be implemented to provided digital form Indian language books for school and higher education.

E-shram portal with registrations I-Cards, 1 crore gig workers. Gig workers platforms bring dynamism to new age services economy. Government will provide healthcare to the gig workers under PM-JAY. PM SVANidhi scheme to be improved to enhance loans from banks UPI linked credit cards.

50000 Atal tinkering labs will be established in many centers in next 5 years. AI led startups will be prominent and funded under the next 5 year plan.

Nuclear energy mission for Viksit Bharat/ Developed India will provide development at least 100gW of nuclear energy by 2047 with amendments to Atomic Energy act and civil liability for Nuclear Damage act.

Tax emptions is increased with economic growth. It was 1 lakh Rs in 2005, 2 lak Rs in 2012, 2.5 lakh Rs in 2014, 5 lakh Rs 2019, 7 lakh Rs in 2023 and 12 lakh Rs in 2024.

To know more download the complete pdf from. Click here.