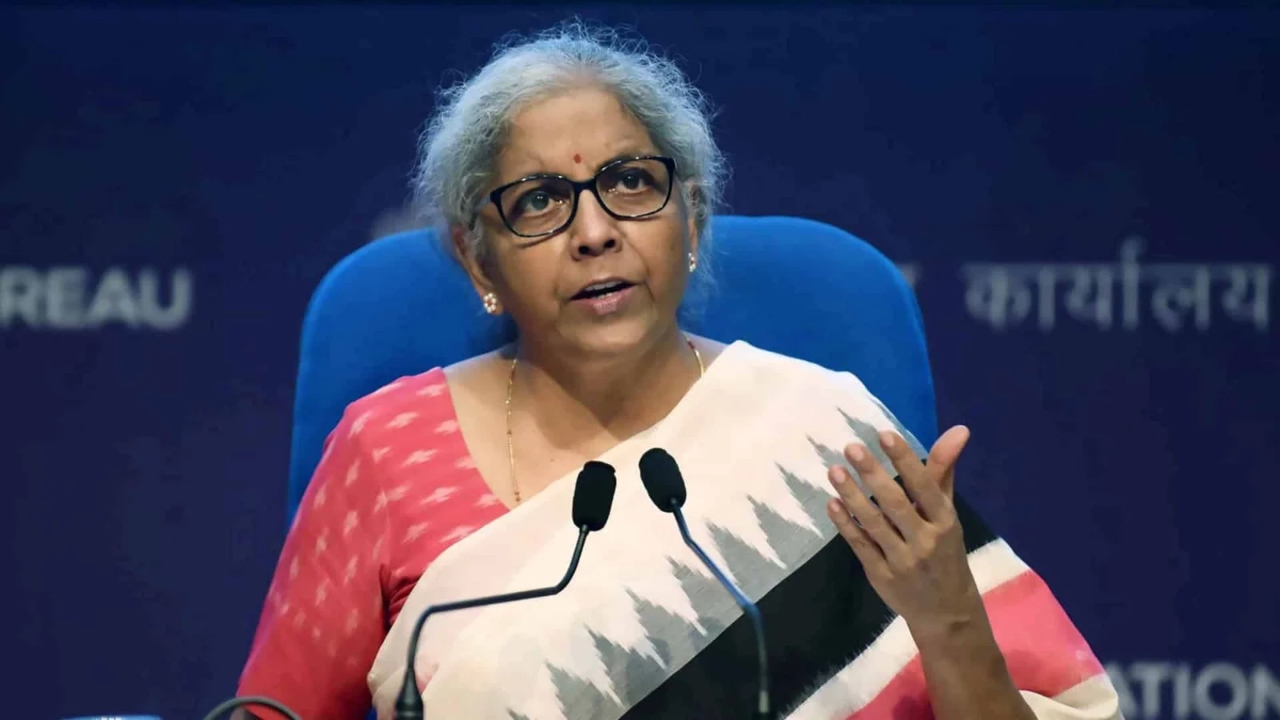

Finance Minister Nirmala Sitaraman exempted people earning Rs 12 lakh and below from income tax this budget, and salaried employees can qualify for additional deductions up to Rs 75,000. You won’t be liable to taxation If the income is up to Rs 13.7 lakh.

It was on the budget day that the whole nation came abuzz debating whether a salaried officer with Rs 13 lakh of annual revenue was liable to be taxed; that is, Rs 12 lakh for senior-citizen pensioners respectively. To draw 75,000 additional exemptions from the current tax applicable on the rest of the income is separate for salaried officers.

This will be a strategy that certainly allows a working person to save Rs 96000 in taxes under the new tax system

Under section 80CCD(2), the contribution for the National Pension Scheme can go up to Rs 96,000 per year with a deduction of 14 percent of basic pay. Under the old scheme, the tax deductions were lower because they were based on 10 percent of basic pay. With an annual salary of Rs 13.7 lakh, one could save around Rs 96,000 with personal contributions to the pension fund.

This extra Rs 96,000 can be saved

Let us imagine that this person had an earning of Rs 13.70 lakh a year. Regular pay is Rs 6.85 lakh a year, and 14 percent of it is the annual contribution to the NPS: that is, Rs 95,900. This rises to Rs 13.70 lakh in the case a standard deduction of Rs 75,000 is made. In this way, if your salary is this high, you won’t have to pay any taxes anymore.

But this option can be availed of if the employer provides the NPS cast to computer (CTC), that is, as benefit by the company. Then one cannot themselves invest in NPS and derive benefits under such provisions.

Dullness with regard to NPS

Interest in the National Pension Scheme-lamps ten years ago-has not been overwhelming. So far, about 22 lakh people have invested in it. The lock-in period is the reason for his lack of interest. Even after his maturity, the investor can withdraw only 60 percent of money under NPS rules, whereas the other 40 percent is compulsory to reinvest.