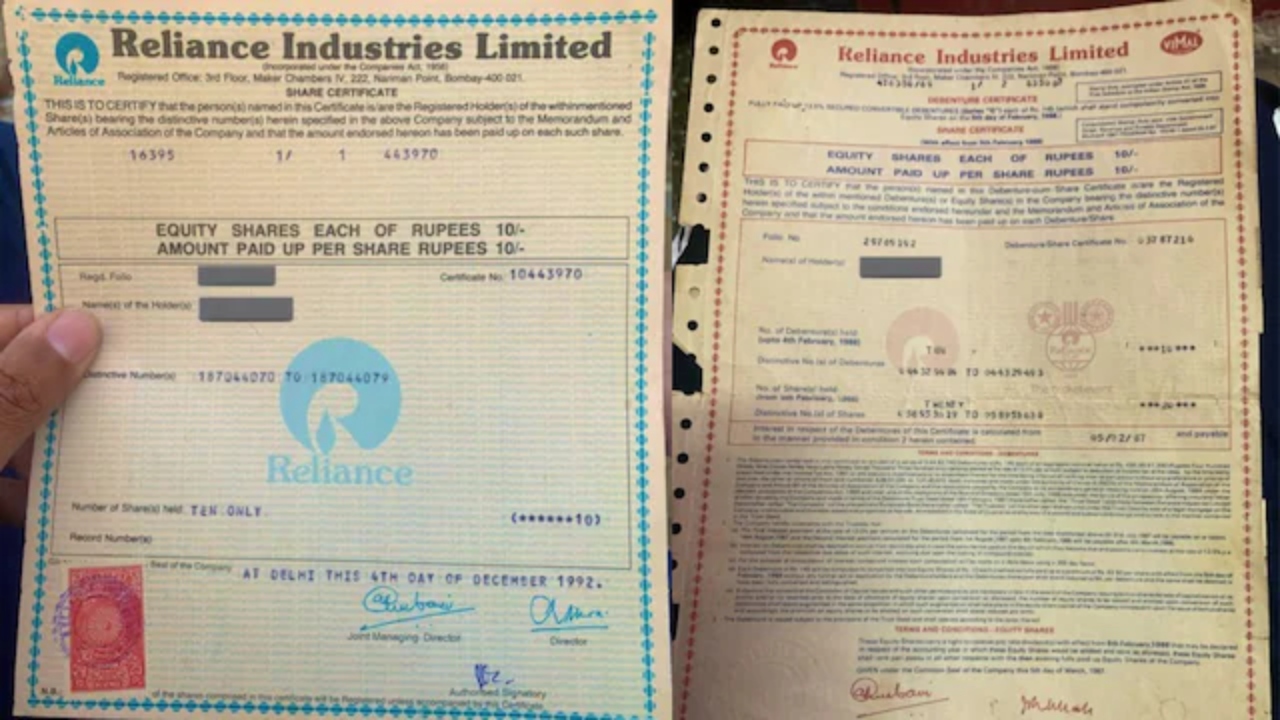

RIL Share Certificates

A Chandigarh-based man, Rattan Dhillon, discovered physical shares of Reliance Industries Limited (RIL) in 1988. This share was originally bought by a deceased family member in the name of RIL’s legendary founder Dhirubhai Ambani, and before that, Dhillon was hesitant to proceed because of all the complications involved in digitizing and reconciling, but finally he has decided to pursue a claim and has promised to donate half of the amount recovered.

The case depicts how difficult it is to retrieve older stock investments in India, which are so dreamy hurdles when it comes to the so-called official process for facilitating such efforts by investors.

The Discovery of 1988 Reliance Shares Dhillon’s surprise discovery of physical share certificates at his residence took him quite by surprise.

These were authenticated back in 1988 when Reliance was under the sole leadership of Dhirubhai Ambani. The share certificates were signed by the late founder himself, which made them very special. He was looking at them as pieces of inheritance, rather than as assets, as there was quite a lot of paperwork involved in claiming them. “It seems therefore that Dhirubhai Ambani’s signatures are going waste as I have

decided not to go ahead with para digitizing the shares.”

Problems in Recovering Old Shares Dhillon’s reluctance stemmed from the fact that he had to go through the long and boring claiming process to take the shares.

Steps involved in cashing RIL Share Certificates

In India, digitization of old physical shares requires several steps, including: Collecting a legal heir certificate, which takes 6-8 months alone. Processing through Investment and Education Protection Fund Authority (IEPFA), which at times can go up to three years.

Completing formalities at depositories like KFin Technologies and NSDL/CDSL to convert physical shares into electronic forms. There was also some expression of “The process is just too long. India needs to thin out this sort of paperwork. For now I will just keep the physical share certificates.”

Change of Heart:

A New Mission His earlier sufferance now changed his mind. Dhillon had made up his mind to take on the challenge of filing a claim of the shares mainly backed by his moral from social media users and words from the regulatory authorities.

In yet another post he announced:RIL Share Certificates

“Upon successfully recovering this 37-year-old investment from Reliance, I will donate half of it to charities supporting the less fortunate, particularly those struggling with medical issues.”There had been a wave of appreciation in this statement with many users praising his determination and generosity.

Current Value of Shares

In terms of cost when bought in 1988 each Reliance share cost very little.Subsequently Reliance Industries has emerged into “the richest company in India.”Dhillon stated he had no idea how much current worth the shares had but then those on social media came together to help him calculate their value today.

It is said then that the shares worth over ₹11 lakh (1.1 million rupees) at present, which is huge owing to what they were worth when purchased.

Support by Regulatory Agencies

It is difficult but guide these institutions in getting along with Dhillon. The credit was given to IEPFA and KFin Technologies towards his completion of the claim application.

He further thanked the Finance Minister Nirmala Sitharaman for establishing those kinds of regulatory bodies which even aid investors in getting back lost investments.”I sincerely appreciate IEPFA for guiding me through the retrieval of my 37-year-old stocks.

Their swift response made all the difference,” he wrote.

Lessons to Be Learned from the Case (RIL Share Certificates)

Here are some things that one’s experience can teach one: The lengthy process to recover old shares discourages a lot of investors from going after their due claims.

A more efficient system can deliver billions of rupees blocked in unclaimed shares. Keeping good records, Lots of families may have shares of big companies lying unclaimed but are not aware of their worth. Keeping proper records and checking portfolios regularly can prevent this situation.

The Power of Social Media – That’s how Dhillon’s journey proved that social media can often become a place where people connect to experts and authorities for advice on financial issues.

Conclusion (RIL Share Certificates)

From an initial pointless endeavor, it became an inspiring mission for Rattan Dhillon-the, the finding of Reliance shares, 37 years old, which has besides bringing up the issues in India’s cumbersome financial paperwork emphasized perseverance. And now supported by the financial authorities and the online community, Dhillon will chase the redemption of those shares to apply some of the money for charitable causes. His story becomes both an inspiring lesson for investors with unclaimed assets.

Bharti Airtel Shares Rise 3% After SpaceX Deal – Is It the Right Time to Invest?

BTSC Recruitment 2025- 7274 vacancies Apply Now!

Udyam MSME Registration Online 2025: A Step-by-Step Guide!

Please follow our WhatsApp channel to get the latest news