How Much Pension Will You Get from Your PF Account After 60

Do you have a PF account as an employee? And are you curious about how much

pension you would accumulate in this PF account after retirement? Well, theThe

Employee Provident Fund Organization (EPFO) has devised certain rules regarding

eligibility and methods of calculation for pension. Understanding these will save you

a lot of hassle in future planning.

Through this article, we will try to explain EPFO pensions in fairly simple terms along

with contribution calculations as well as the amount you may expect to have at

retirement age of 60.

What is the EPFO Pension Scheme?

The EPFO pension scheme, also known as the Employee Pension Scheme (EPS),

is a retirement benefit that employees receive in India. This ensures that upon

retirement, the employees shall receive a pension under the defined conditions.

Who Can Claim EPFO Pension?

In order to receive an EPFO pension, the person needs to:

1. Contribute in EPF (Employees’ Provident Fund) for ten years without break,

2. Complete age of fifty years for reduced pension, or at fifty-eight years for full

pension,

3. Post 60 years to avail those other pension benefits.

If one contributes less than ten years, he is not eligible under the pension scheme

but can withdraw his total accumulated amount.

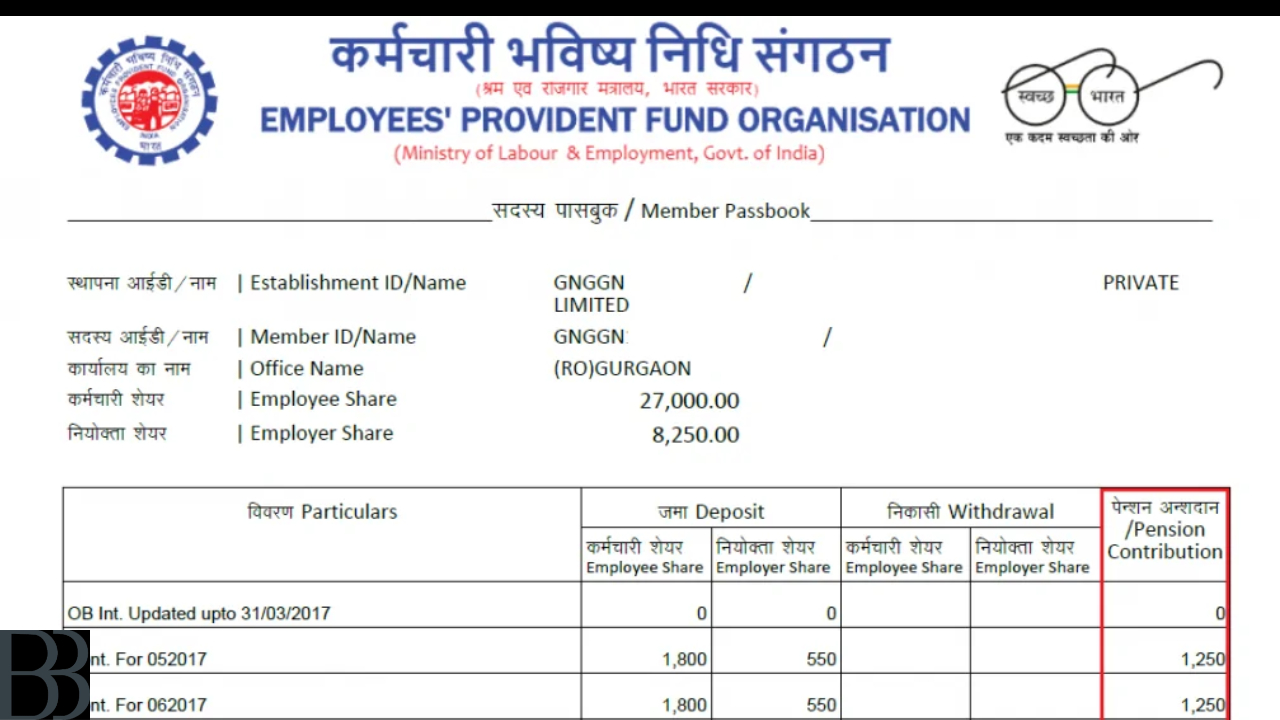

How is Money Deposited into Your PF Account?

Every month both you and your employer contribute 12% of your basic salary and

dearness allowance (DA) to your EPF account. However, this contribution is split in

the following way:

Your contribution: 12% goes directly into the EPF.

Your employer’s contribution: 8.33% goes into the EPS (pension fund), and 3.67%

goes into the EPF.

For example, if your basic salary is ₹15,000, then the contributions made by your

employer toward a pension fund would be:

₹15,000 × 8.33% = ₹1,250 per month.

Every month, this amount is deposited into your pension fund till your retirement.

EPFO Pension Laws and Retirement Age

1. Early Pension at 50 Years

If one wants to draw his pension at 50 years, one gets a lower amount.

Pension is reduced by 4% for each year for the period before 58.

2. Full Pension at 58 Years

In other words, on waiting until reaching 58 years, you become entitled to the full

pension.

3. Extra Benefit at 60 Years

Thus, if one delays till the age of 60 years, the withdrawal from one’s pension

account, an 8 % increase takes place in the monthly pension.

This is added because EPFO adds an increment of 4% per year after 58 years.

Thus, waiting until 60 would help because it can offer a greater amount in the end for

the pension.

How is your Pension Calculated?

The very simple formula that EPFO uses for the calculation of the pension is:

Pensionable Salary × Years of Service / 70 = Monthly Pension

Here,

Pensionable Salary = Average of last 60 months’ basic salary (maximum limit

₹15,000).

Years of Service = Total years you have worked and contributed to EPFO.

How much will your pension be at 60?

We will take an example to explain this better:

Assuming a person started at 23 years of age and happily retired at 58 years of age.

The total service period = 35 years.

Pensionable salary (average salary of the last 60 months) = ₹15,000

Now comes the formula:

₹15,000 × 35 / 70 = ₹7,500/months.

However, if you wait until the age of 60 to claim your pension, you get an additional

8% increase in your pension amounting to ₹8,100/month.

Key Takeaways

To qualify for an EPFO pension, you must contribute for a minimum of 10 years.

If a member withdraws their pension between the ages of 50 and 58 deductions are

paid.

Waiting until 60 results in an increase of 8% in your pension.

The pension is based on salary for the last 60 months.

Conclusion

Retirement planning is important for any person; hence, knowing how EPFO pensions

work will provide you with a way to go about it. Contributing regularly to your PF account

and waiting until 60 to claim your pension will give you added advantages for your

monthly pension.

Do check your EPF passbook online or explore more information on the EPFO

website in case of any queries. Make well-informed decisions today and secure your

tomorrow!

Please read other news:

Oneplus soon to launch new phone: All details about the OnePlus 13T

Sell That Rare ₹5 Tractor Note Online And Make A Profit Of Almost ₹2 Lakh

RailTel Share Price Surges Like a Bullet Train, Jumped 9% Today! Investors Excited

Hidden Treasure: Your ₹2 Coin Could Turn Into a Money-Maker!

War Returns to Gaza: Israel’s Ground Offensive Sparks Bloodshed

For the latest updates, join our WhatsApp channel:

https://whatsapp.com/channel/0029Vb0RZMy3LdQbd5tc8V2c

How Much Pension Will You Get from Your PF Account After 60, How Much Pension Will You Get from Your PF Account After 60, How Much Pension Will You Get from Your PF Account After 60, How Much Pension Will You Get from Your PF Account After 60 How Much Pension Will You Get from Your PF Account After 60 How Much Pension Will You Get from Your PF Account After 60